Compound Interest Rates

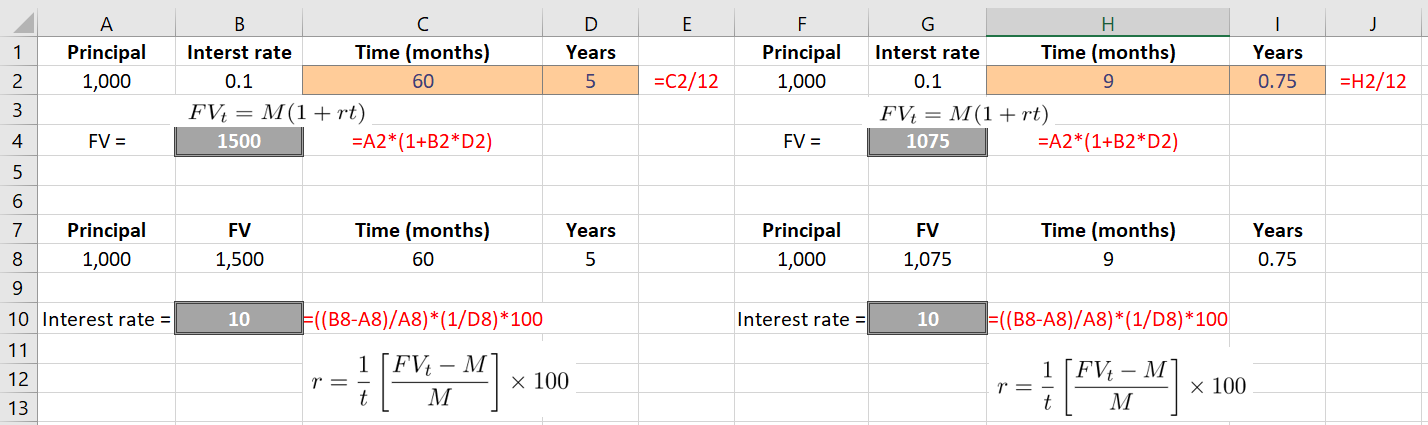

Let's re-state our previous example: if $1,000 is invested for a year at the interest rate of 10% per annum with annual compounding, you are going to receive at the end of the year a return of

![]()

Your investment earns $100 at the end of the year. The value of your investment at the end of the first year is $1,100. We can write the value of your investment as

![]()

If $1,000 is invested for two years at the interest rate of 10% per annum with annual compounding, you are going to receive at the end of the first year a return of

![]()

The value of your investment is

![]()

![]()

In the second year, you invest $1,100 at 10% for another year. The value of your investment would be

![]()

![]()

Or we can write as follows:

![]()

![]()

![]()

Now, if you invest $1,210 for the third year at 10%, the value of your investment would be

![]()

We can also write the above equation as

![]()

⇒

![]()

We can continue this way for years 4 and 5 with outcomes as follows:

![]()

![]()

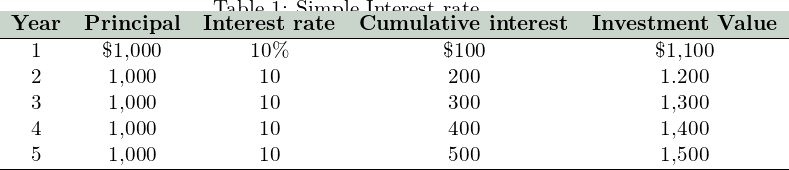

In this case, your investment of $1,000 earns $610.51 at the end of five years. The value of your investment grows to $1,610.51 rather than $1,500.

In the above example, (1+0.10), (1+0.10)2, (1+0.10)3, (1+0.10)4, (1+0.10)5 show how $1 investment grows every year:

![]()

![]()

![]()

![]()

![]()

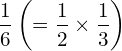

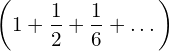

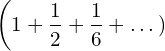

If you subtract $1 in each equation above, we get the effective interest rate:

![]()

![]()

![]()

![]()

![]()

The effective interest rate when the interest rate compounds annually,

![]()

Compare the above calculations with the simple interest rate, where interest rates do not compound. It remains 10% without compounding annually. When 10% compounds annually, the effective rate increases from 10% in the first year to 61.051% in the fifth year.

As you can see now that a $1,000 investment at a 10% continuously compounded interest rate can $610.51 as opposed to $500 with a simple interest rate.

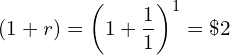

Let's $$1,000 = M0, and (1+0.10)t = (1+r)t, then we can write, Future Value, FVt:

![]()

In other words, the future value of $1 can be written as (1+r)t, which is the compound factor.

Let's now consider one year:

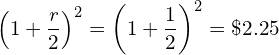

- When we compound r semi-annually in one year the amount $1 grows to

![Rendered by QuickLaTeX.com \[\left(1+\frac{r}{2}\right)^2\]](data:image/svg+xml,%3Csvg%20xmlns='http://www.w3.org/2000/svg'%20viewBox='0%200%2082%2043'%3E%3C/svg%3E)

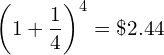

- When we compound r quarterly in one year the amount $1 grows to

![Rendered by QuickLaTeX.com \[\left(1+\frac{r}{4}\right)^4\]](data:image/svg+xml,%3Csvg%20xmlns='http://www.w3.org/2000/svg'%20viewBox='0%200%2082%2043'%3E%3C/svg%3E)

- When we compound r monthly in one year the amount $1 grows to

![Rendered by QuickLaTeX.com \[\left(1+\frac{r}{12}\right)^{12}\]](data:image/svg+xml,%3Csvg%20xmlns='http://www.w3.org/2000/svg'%20viewBox='0%200%20100%2043'%3E%3C/svg%3E)

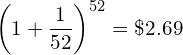

- When we compound r weekly in one year the amount $1 grows to

![Rendered by QuickLaTeX.com \[\left(1+\frac{r}{52}\right)^{52}\]](data:image/svg+xml,%3Csvg%20xmlns='http://www.w3.org/2000/svg'%20viewBox='0%200%20100%2043'%3E%3C/svg%3E)

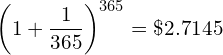

- When we compound r daily in one year the amount $1 grows to

![Rendered by QuickLaTeX.com \[\left(1+\frac{r}{365}\right)^{365}\]](data:image/svg+xml,%3Csvg%20xmlns='http://www.w3.org/2000/svg'%20viewBox='0%200%20119%2043'%3E%3C/svg%3E)

Thus, in general, when we compound r m-times in one year the amount $1 grows to

![]()

Let's now consider t years:

When we compound r m-times in one year for t years the amount $1 grows to

![]()

Therefore, Future value:

![]()

Let's consider the following example:

(b) You are given: t = 3, m = 12, r = 8%, P0 = $5000, what is future value, M12?

(c) You are given: t = 3, m = 52, r = 8%, P0 = $5000, what is future value, M52?

Solution:

(a)

![]()

![Rendered by QuickLaTeX.com \[M_2 = 5,000 \left(1+\frac{0.08}{2} \right)^{2\times 3} = 5,000(1+0.04)^6=5000(1.265) = 6,325\]](https://myriskbook.com/wp-content/ql-cache/quicklatex.com-4c1dfd2cf42435ecc899880e5e7a6667_l3.png)

(b)

![]()

![Rendered by QuickLaTeX.com \[M_12 = 5,000 \left(1+\frac{0.08}{12} \right)^{12\times 3} = 5,000\left(1+0.0067\right)^{36}=5000\left(1.272\right)=6,360\]](https://myriskbook.com/wp-content/ql-cache/quicklatex.com-8eed133e9ff3c3e7c68e57b1411398f4_l3.png)

(c) You do it.

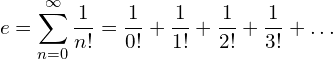

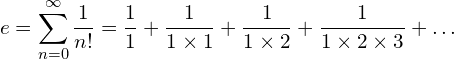

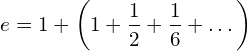

![Rendered by QuickLaTeX.com \begin{equation*} e= \lim_{n\to \infty}\left [1+{\frac{1}{n}\right]}^n \end{equation*}](https://myriskbook.com/wp-content/ql-cache/quicklatex.com-c7b276c7dd6c6790ccd3c0095c772f04_l3.png)

![Rendered by QuickLaTeX.com \begin{equation*} e^r=\sum_{n=0}^{\infty}{\frac{r^n}{n!}}={\frac{1}{0!}}+{\frac{r}{1!}}+{\frac{r^2}{2!}}+{\frac{r^3}{3!}}+\dots= \lim_{n\to \infty}\left [1+{\frac{r}{n}\right]}^n \end{equation*}](https://myriskbook.com/wp-content/ql-cache/quicklatex.com-29751f9dcd22e4474101e3870800dc22_l3.png)

![Rendered by QuickLaTeX.com \begin{equation*} \lim_{n\to \infty}\left [1+{\frac{0.25}{n}\right]}^n \end{equation*}](https://myriskbook.com/wp-content/ql-cache/quicklatex.com-aeeca399abdc2acd6fe8dcf0e6e84b0f_l3.png)

![Rendered by QuickLaTeX.com \[r = \frac{1}{t}\left [\frac{FV_t}{M} - 1\right]\]](https://myriskbook.com/wp-content/ql-cache/quicklatex.com-64bd419aebf7e950c8c97607caad81e3_l3.png)

![Rendered by QuickLaTeX.com \[r = \frac{1}{t}\left [\frac{FV_t-M}{M}\right]\]](https://myriskbook.com/wp-content/ql-cache/quicklatex.com-4d10f61717d6446bcf6ac701ac58e484_l3.png)

![Rendered by QuickLaTeX.com \[r = \frac{1}{t}\left [\frac{FV_t-M}{M}\right]\times 100\]](https://myriskbook.com/wp-content/ql-cache/quicklatex.com-3890ac1d19f7d0fc1d97a0a70b47b239_l3.png)